finbots.ai

About finbots.ai

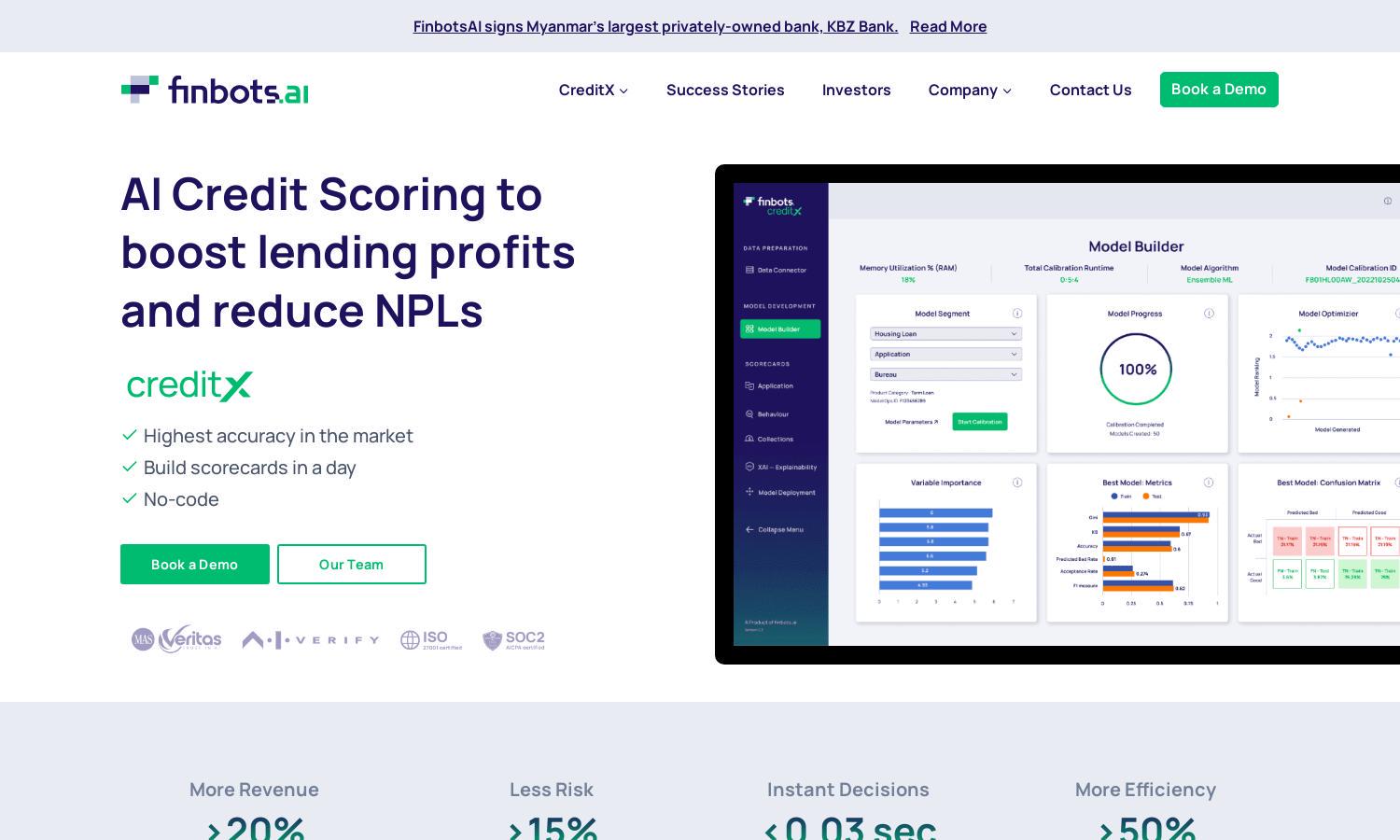

finbots.ai is a cutting-edge platform designed to optimize credit risk management for lenders using AI technology. It enables users to create and deploy customized scorecards efficiently, leading to more accurate lending decisions. Ideal for banks and financial institutions aiming to enhance profitability and reduce non-performing loans.

finbots.ai provides flexible pricing plans tailored for different lending needs. The offer includes 30% off for the first six months, with potential for further discounts based on usage. Upgrading offers enhanced features and increased profitability, making it an attractive option for all lenders.

finbots.ai features a user-friendly interface designed for seamless navigation and quick access to its tools. Its layout promotes efficient use, facilitating easy deployment of credit scorecards. The intuitive design combined with powerful analytics ensures that users can derive maximum value from the platform.

How finbots.ai works

Users begin by onboarding onto finbots.ai, providing access to their data sources. They can then utilize the platform's powerful AI capabilities to automatically build, validate, and deploy customized credit scorecards. The system supports real-time decision-making, with an efficient one-click deployment for optimized lending processes.

Key Features for finbots.ai

AI-Powered Credit Scorecards

finbots.ai’s standout feature, AI-Powered Credit Scorecards, allows financial institutions to create tailored credit assessments quickly. This innovation streamlines the decision-making process, providing lenders with enhanced risk evaluations, leading to improved approval rates and reduced default risks, thereby supporting smarter lending practices.

Real-Time Decisioning

The Real-Time Decisioning feature of finbots.ai revolutionizes lending by allowing instant credit evaluations. This ensures that financial institutions can respond quickly to borrower applications, enhancing user satisfaction and operational efficiency. By leveraging AI, finbots.ai provides accurate outcomes within milliseconds, significantly improving the lending experience.

Comprehensive Data Integration

finbots.ai excels in Comprehensive Data Integration, enabling seamless connections to internal, external, and alternate data sources. This capability allows users to enhance their credit evaluations with diverse information, ensuring a thorough assessment process that drives informed lending decisions and reduces risk for institutions.