Kavout

About Kavout

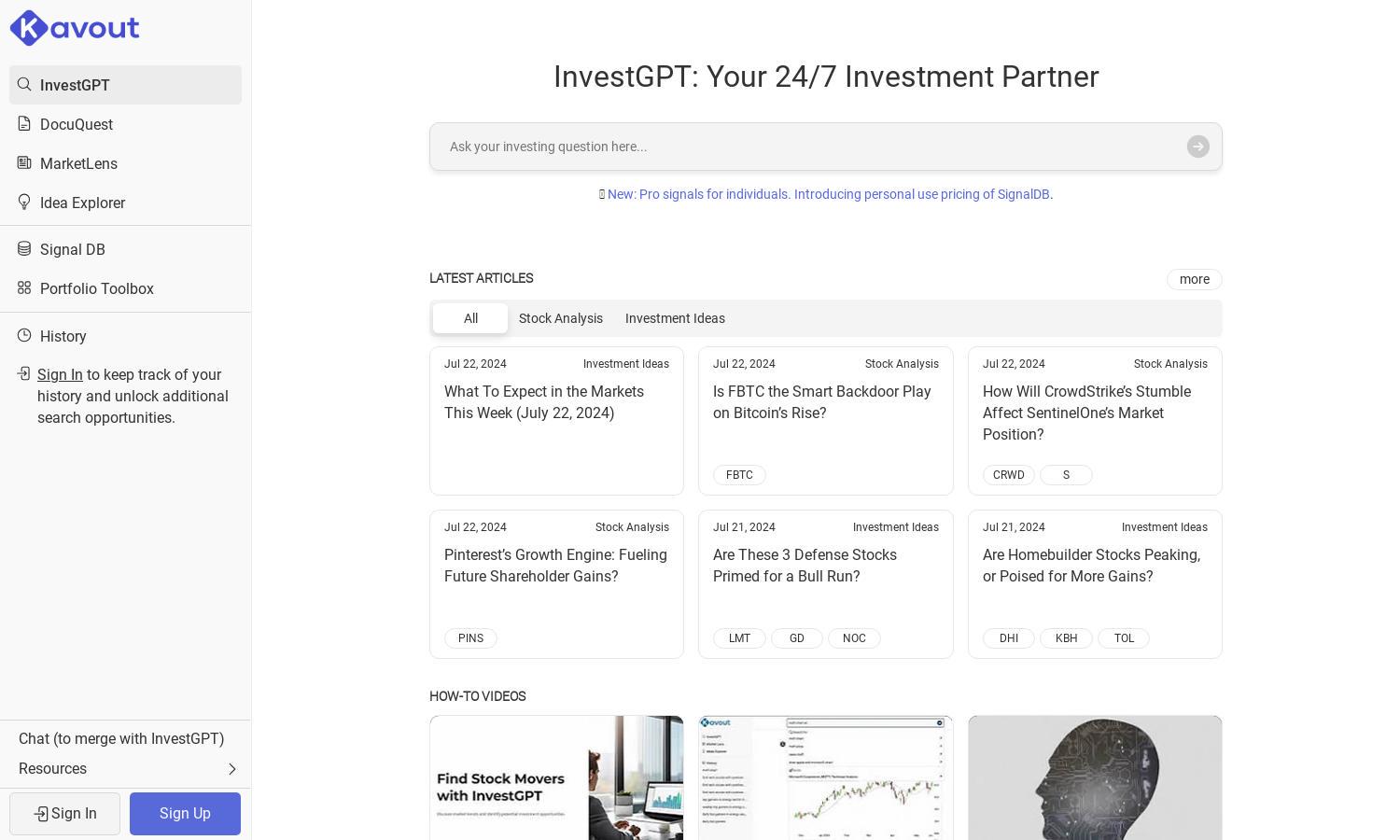

Kavout is an innovative investment platform that leverages AI to deliver personalized insights on U.S. stocks and ETFs. Targeted at investors seeking a data-driven approach, it offers tools like InvestGPT for real-time analysis and strategies to streamline decision-making, ensuring enhanced investment performance and confidence.

Kavout offers both free and premium subscription tiers. The Pro plan includes advanced AI signals, stock ideas, and exclusive insights. Users can access upgraded features for a more complete investment experience. Upgrade now for deeper analysis and tailored recommendations to optimize portfolio performance.

Kavout features an intuitive user interface, designed for seamless navigation and a rich user experience. Its organized layout enhances accessibility and usability, ensuring that investors can easily access essential tools and insights. The platform's design promotes efficient interaction with its AI-driven features.

How Kavout works

To begin using Kavout, users sign up and undergo a simple onboarding process. The platform guides them through its features, including InvestGPT for customized insights and analysis of stocks and ETFs. Users can explore market trends and leverage tools that allow dynamic stock selection, improving their investment strategies.

Key Features for Kavout

AI Stock Picker

Kavout's AI Stock Picker feature utilizes cutting-edge algorithms for dynamic investment recommendations. This functionality helps users discover optimal stocks based on comprehensive data analysis, enabling them to make informed financial decisions and improve portfolio performance with confidence.

Market Trends Analysis

Kavout's Market Trends Analysis provides real-time insights into stock performance and market dynamics. This feature enables users to stay informed about the latest market movements, empowering them to seize investment opportunities and refine their strategies for greater financial success.

Personalized Analytics

Kavout offers Personalized Analytics allowing users to receive tailored stock recommendations based on their unique objectives and risk tolerance. This customized approach ensures that investors can effectively align their portfolios with market conditions, ultimately boosting their investment success.