Monarch Money

About Monarch Money

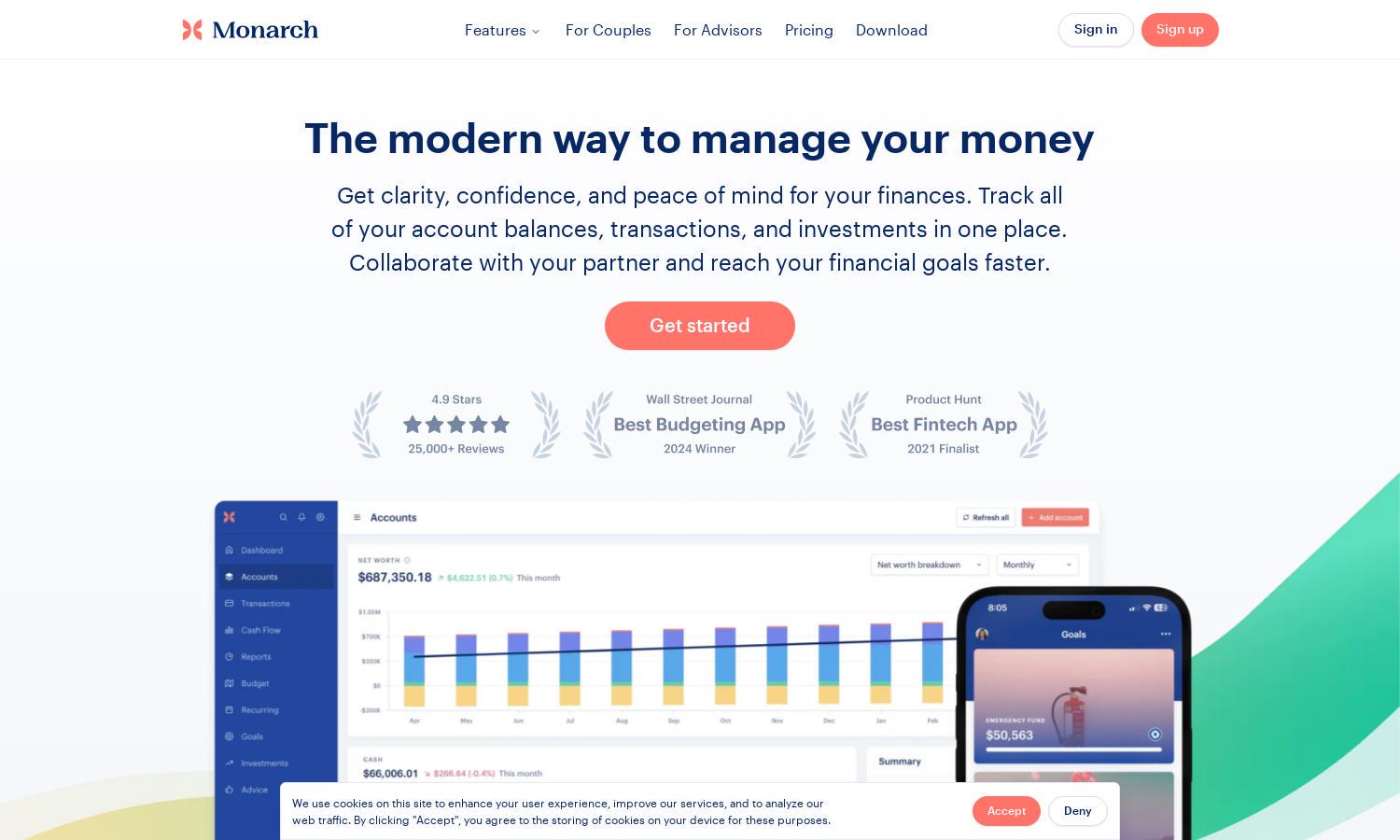

Monarch Money is a comprehensive platform designed for individuals and couples seeking effective personal finance management. With innovative features like Bill Sync, AI-enhanced transaction organization, and investment tracking, Monarch simplifies budgeting and goal achievement, offering clarity and confidence in financial decisions for a resilient financial future.

Monarch Money offers competitive pricing, with a 30% discount for the first year using the code WELCOME. It provides various subscription tiers that unlock advanced features, ensuring users receive maximum value from their investment in budgeting, financial tracking, and collaborative planning tools, fostering better financial outcomes.

Monarch Money features an intuitive user interface designed for a seamless browsing experience. Its elegant layout and user-friendly tools enhance financial management by making navigation easy. Detailed dashboards, customizable reports, and data visualization features help users understand their financial situations at a glance, improving overall usability.

How Monarch Money works

To start using Monarch Money, users sign up and can easily link all their financial accounts for a comprehensive view of their finances. The platform’s intuitive dashboard displays all transactions, while AI organizes them for clarity. Users can set financial goals, create budgets, and collaborate with partners or advisors to optimize spending and track progress toward achieving their goals, all in one secure place.

Key Features for Monarch Money

Bill Sync

Bill Sync is a standout feature of Monarch Money that allows users to effortlessly synchronize their bills within the platform. This unique capability enables individuals to manage due dates, track expenses, and ensure timely payments, significantly reducing financial stress and providing clarity in achieving financial goals.

AI Transaction Organization

Monarch Money utilizes AI technology to automatically categorize and clean transactions, learning user preferences over time. This feature enhances financial tracking by keeping users organized and ensuring they have a clear understanding of their spending patterns, ultimately leading to more informed financial decisions and better budgeting.

Collaborative Financial Planning

The collaborative financial planning feature of Monarch Money enables users to invite partners or financial advisors to join their financial journey. This unique aspect ensures that both parties have a shared view of their finances, fostering better communication and collaboration in reaching shared financial goals together while ensuring transparency.