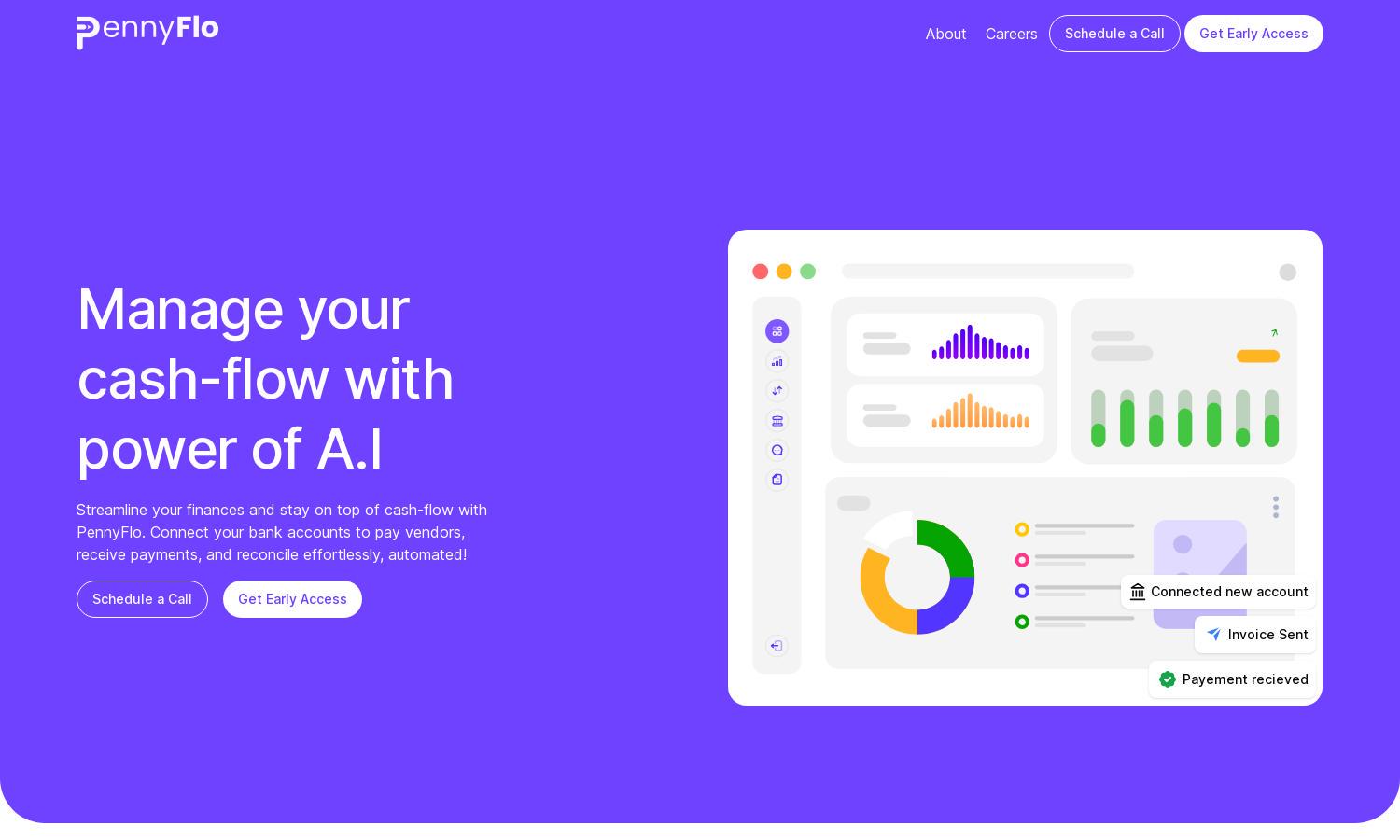

Pennyflo

About Pennyflo

Pennyflo is an innovative cash management platform tailored for businesses seeking to optimize financial workflows. Its intuitive interface integrates seamlessly with various tools, offering real-time cash flow insights and task automation. Users can effortlessly manage their finances, make data-driven decisions, and mitigate cash shortages for sustainable growth.

Pennyflo's pricing plans cater to diverse business needs, providing tiered options that scale with user requirements. Each subscription includes features like cash flow management, dynamic forecasts, and reporting tools. Upgrading unlocks advanced capabilities, ensuring users gain optimal value from their cash management processes.

The user interface of Pennyflo is designed for convenience and efficiency, allowing users to navigate its features effortlessly. With a clean layout and intuitive controls, the platform enhances user experience, ensuring that finance teams can quickly access cash flow insights, automate tasks, and generate reports seamlessly.

How Pennyflo works

To start using Pennyflo, users simply sign up and undergo a straightforward onboarding process. Once registered, they can integrate their favorite financial tools and sync data for real-time insights. The platform allows users to automate bookkeeping tasks, generate financial reports, and collaborate with team members effortlessly, making cash management simple and efficient.

Key Features for Pennyflo

AI-powered co-pilot for finance teams

Pennyflo's AI-powered co-pilot is a standout feature that helps finance teams automate repetitive tasks and streamline workflows. This functionality reduces manual effort, allowing users to focus on strategic financial decisions and ensuring accurate, timely cash flow management to drive business growth.

Dynamic Forecasts

Pennyflo’s dynamic forecasting tools utilize real-time data to help businesses plan for varying financial scenarios. By leveraging historical trends and predictive analytics, users can anticipate cash flow fluctuations, enabling proactive decision-making and enhanced financial stability for greater business resilience.

Automated Banking & Reconciliations

Automated banking and reconciliations offered by Pennyflo simplify the tedious finance operations. This feature ensures accurate tracking of transactions and helps users maintain precise records effortlessly. By automating reconciliations, Pennyflo saves time and reduces errors, allowing finance teams to work smarter and more efficiently.

You may also like: