Player2.tax

About Player2.tax

Player2.tax is your go-to AI chatbot for navigating Australian taxation complexities. It offers quick, reliable assistance based on extensive taxation data and legislation, ideal for individuals seeking to streamline their tax research. Save hours of time and make informed decisions with Player2.tax.

Player2.tax offers flexible subscription plans catering to various user needs. While basic access is free, premium subscriptions provide enhanced features and personalized support, ensuring optimal value for users. Upgrade to enjoy comprehensive tax assistance and exclusive resources, simplifying your tax journey and saving time.

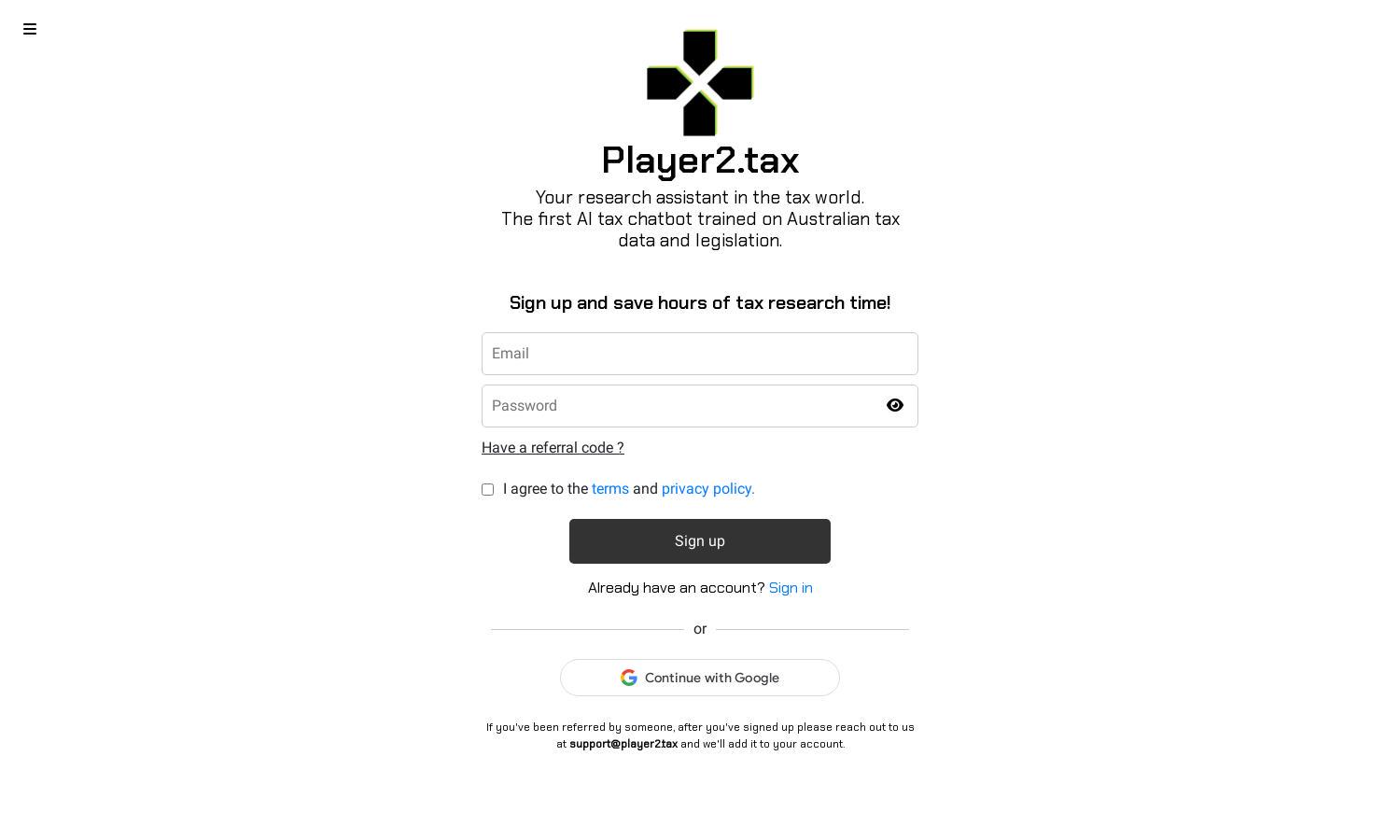

The user interface of Player2.tax is designed for seamless navigation and ease. Its clean layout and intuitive features facilitate quick access to core functionalities, ensuring users can efficiently manage their tax inquiries. Experience a user-friendly design that enhances your interaction with Player2.tax.

How Player2.tax works

Users start by signing up on Player2.tax, followed by a simple onboarding process that familiarizes them with the platform. Once logged in, they can easily engage with the AI chatbot for tax-related questions, access resources, and receive tailored advice, enhancing their research experience significantly.

Key Features for Player2.tax

AI Tax Assistance

Player2.tax offers unparalleled AI tax assistance using a sophisticated chatbot trained on Australian tax legislation. This unique feature enables users to receive prompt answers to their tax queries, simplifying the research process and significantly reducing the time spent on tax-related tasks.

Personalized Support

With Player2.tax, users benefit from personalized support that tailors assistance to individual tax needs. This feature ensures that users receive relevant, targeted advice, enhancing their overall experience and making tax management more effective and efficient, setting Player2.tax apart from generic tax tools.

Comprehensive Resources

Player2.tax provides users with access to comprehensive tax resources, including guides and relevant legislation. This feature empowers users by equipping them with essential knowledge while navigating their tax obligations, thus making informed decisions that can lead to significant savings and compliance confidence.

You may also like: