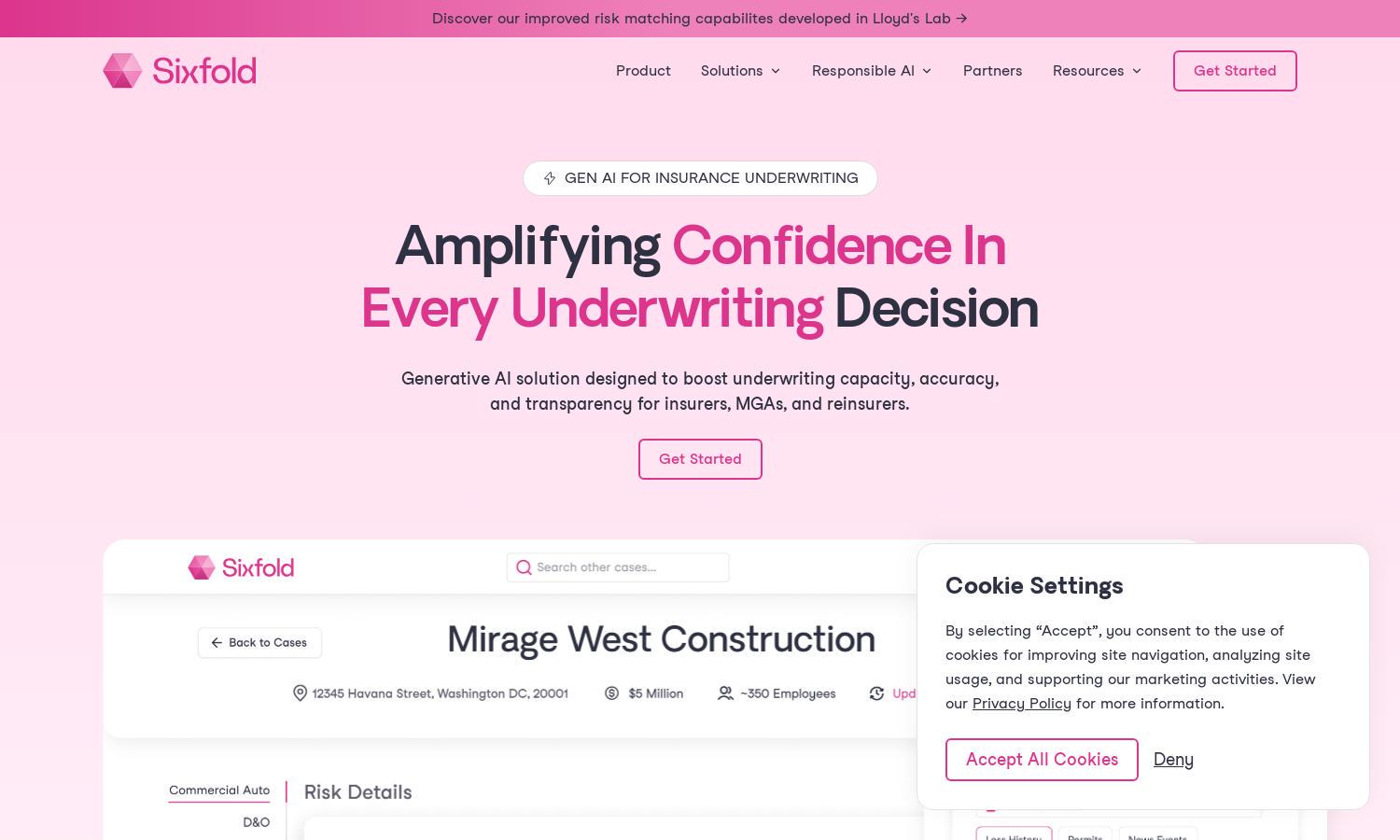

Sixfold

About Sixfold

Sixfold revolutionizes insurance underwriting with generative AI, streamlining tedious tasks and enhancing decision-making. Designed for insurance professionals, it automates risk data extraction and generates tailored recommendations. Users benefit from transparent processes, compliance assurance, and improved workflow efficiency, addressing challenges in risk assessment.

Sixfold offers flexible pricing plans tailored to different underwriting needs. Each tier provides unique features, enhancing access to powerful AI tools. Users can enjoy trial periods or exclusive discounts for early sign-ups, making it an affordable solution for automating insurance processes and improving underwriting decisions.

The user interface of Sixfold is designed for optimal navigation, offering a clear layout that enhances usability. Key features such as risk signal detection and automated summaries provide a seamless experience. This intuitive design empowers underwriters to access necessary insights quickly, improving their workflow productivity.

How Sixfold works

To engage with Sixfold, users begin by onboarding their underwriting guidelines into the system, allowing it to tailor recommendations based on specific risk appetites. As users navigate the platform, they can ingest submissions, extract relevant risk data, and receive automated insights, enhancing their decision-making process while ensuring compliance with transparency in each step.

Key Features for Sixfold

Automated Risk Analysis

Sixfold's automated risk analysis feature sets it apart, allowing underwriters to quickly synthesize vast amounts of data. Users benefit from tailored insights and recommendations, streamlining the underwriting process while maintaining full transparency and compliance throughout their decision-making.

Risk Signal Detection

Risk signal detection is a key feature of Sixfold, empowering underwriters to identify positive, negative, or disqualifying risk factors efficiently. This enhances decision-making accuracy and reduces the workload by quickly highlighting critical data points, ensuring a more effective underwriting process.

Seamless Integration

Sixfold offers seamless integration with existing legacy systems, enabling insurers to incorporate advanced AI capabilities without overhauling their entire infrastructure. This unique feature ensures a smoother transition and maximizes the utility of current technology while boosting underwriting efficiency dramatically.

You may also like: