Skwad

About Skwad

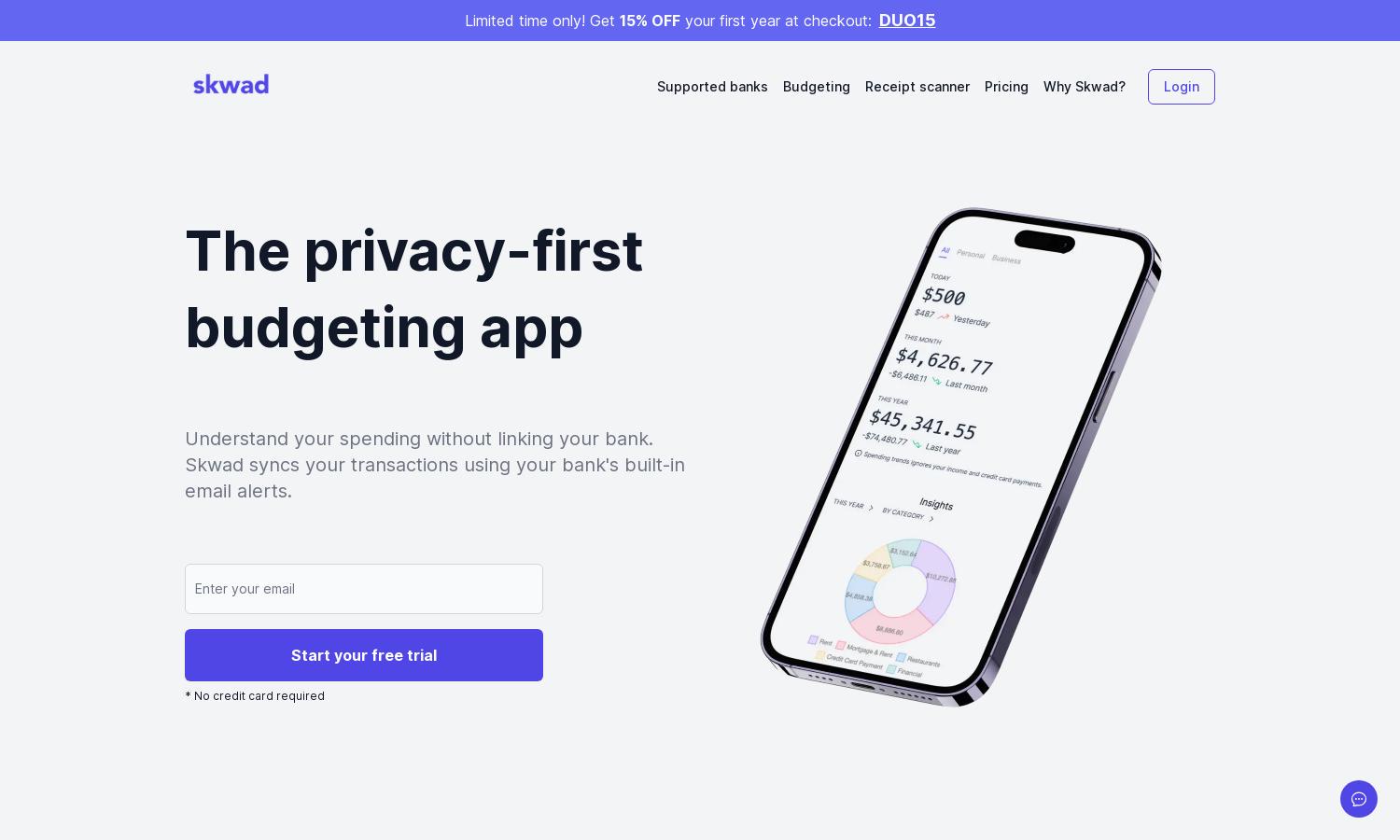

Skwad is a privacy-first budgeting app designed for users who want financial clarity without sharing bank logins. By using built-in email alerts from banks, it automates tracking spending and income seamlessly. Skwad’s unique approach ensures instant transaction syncing, allowing users to gain control and insights into their finances effectively.

Skwad offers flexible subscription plans catering to diverse budgets. Users can start with a free trial, enjoying features like transaction automation. Unlock additional benefits with premium tiers for advanced insights and customization options. Plus, use code DUO15 to receive 15% OFF your first year, adding even more value.

Skwad features a streamlined user interface that enhances the budgeting experience. Its layout is intuitive, allowing users to navigate effortlessly through features like transaction categorization and alerts. With user-friendly tools and visuals for financial analysis, Skwad ensures a pleasant and efficient journey toward better money management.

How Skwad works

To use Skwad, users sign up and receive a unique scan email address. By setting up automated alerts from their bank to this address, transactions are instantly synced and categorized. The app's design prioritizes ease of use, enabling users to track spending effectively without needing to log in to their banks.

Key Features for Skwad

Instant Transaction Syncing

Skwad’s instant transaction syncing allows users to track expenses in real-time without bank login credentials. By leveraging email alerts from banks, Skwad ensures that every transaction is processed immediately, giving users up-to-date insights into their financial activities and enhancing overall budgeting efficiency.

Automated Categorization

Skwad’s automated categorization feature simplifies budgeting by categorizing transactions for users as alerts arrive. This unique functionality minimizes the time spent on manual entry, allowing users to focus on financial insights and effective spending management, resulting in a clearer understanding of their finances without hassle.

Privacy-First Approach

Skwad’s privacy-first approach sets it apart by eliminating the need for users to share sensitive bank login information. This feature not only enhances security but also provides users with peace of mind, knowing their financial data is protected while still allowing effective expense tracking and management.

You may also like: