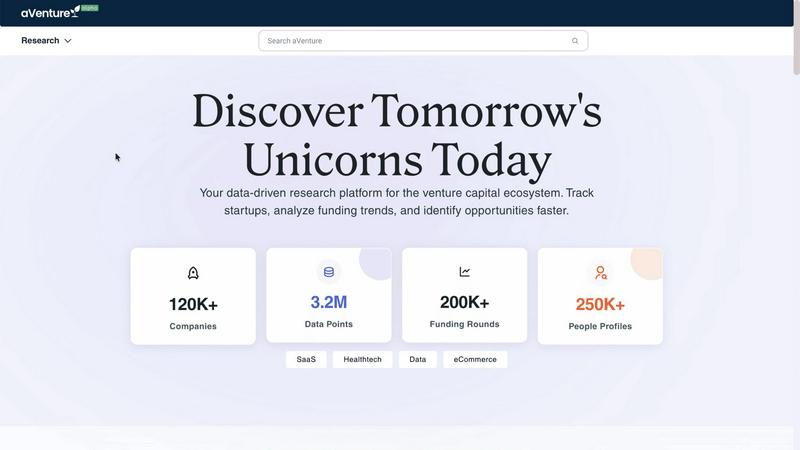

aVenture

aVenture is an AI-powered platform for institutional-grade research on over 100,000 private companies and venture cap...

Visit

About aVenture

aVenture is an institutional-grade venture intelligence platform designed for comprehensive research on private companies and venture capital investment activities. It functions as a centralized data hub, tracking over 109,217 active venture-backed companies across 132 countries, aggregating data from more than 1,200 sources to deliver over 12.8 million distinct data points. The platform's core value proposition is transforming raw venture data into actionable insights through advanced analytics and proprietary AI-driven synthesis. Its AI analyst engine continuously processes the latest news and coverage to generate concise summaries of company traction, highlight potential risks, and explain the material impact of new events. aVenture serves a professional user base including founders preparing for fundraising, investment analysts conducting due diligence and market mapping, business development teams scouting for partners or customers, and corporate operators monitoring their competitive landscape. By providing deep visibility into funding histories, ownership structures, competitive positioning, and investor portfolios, aVenture enables data-driven decision-making for identifying emerging opportunities, diligencing deals, and building targeted outreach strategies with precision.

Features of aVenture

Comprehensive Company Database

The platform maintains a dynamic database of over 109,217 private companies, tracking key metrics such as market sector, development stage, fundraising history, and total funding, which exceeds $12.7 trillion. Each company profile provides detailed insights into competitors, adjacent markets, and "look-alike" companies for competitive analysis. The system is updated in real-time, with platform metrics showing a 2.4% growth in tracked companies, ensuring users have access to the most current venture landscape data for accurate research and diligence.

AI-Powered Analyst & News Tracking

aVenture deploys a proprietary AI analyst that autonomously reads and synthesizes the latest news coverage and market signals for tracked entities. This feature filters out noise to deliver concise updates that surface only material changes affecting a company's status. The AI summarizes traction, highlights operational or financial risks, and provides contextual explanations on how specific events—such as new product launches or leadership changes—may impact the company's future prospects and valuation.

Advanced Investor Mapping Tools

This feature enables detailed analysis of investor portfolios, showcasing every company a specific venture capital firm or angel investor has backed. Users can filter these portfolios by multiple criteria including sector, investment stage, geographic location, and deal size to identify investment patterns. This capability is essential for building highly targeted outreach lists for fundraising, understanding an investor's thesis, or conducting peer analysis within a specific investment vertical.

Collaborative Workspace & Data Export

aVenture includes robust workspace functionality designed for team-based research. Users can save custom lists of companies or investors, annotate individual profiles with private notes, and share curated research folders with colleagues. The platform supports data export in various formats, allowing for further analysis in external tools. This facilitates seamless collaboration among analysts, investment committees, and business development teams during extended diligence processes or ongoing market surveillance.

Use Cases of aVenture

Due Diligence for Investment Analysis

Investment professionals utilize aVenture to conduct thorough due diligence on potential deals. Analysts examine a target company's complete funding history, cap table, competitive positioning, and news sentiment generated by the AI analyst. By reviewing competitors and market sizing data, they can assess market fit, growth potential, and investment risks with a depth of information that supports confident investment recommendations and committee presentations.

Market Mapping & Competitive Intelligence

Operators and strategists use the platform to build detailed market maps and monitor their competitive landscape. By searching and filtering the extensive database by sector, technology, or geography, users can identify emerging startups, track competitor fundraising and hiring activities, and understand market saturation. This intelligence informs strategic planning, product development roadmaps, and potential partnership or acquisition opportunities.

Targeted Fundraising Outreach for Founders

Founders preparing for capital raises leverage aVenture's investor mapping tools to identify and prioritize potential investors. They can filter investors by those who actively fund their specific sector, stage, and region, and analyze past investments to tailor their pitch. Understanding an investor's portfolio helps founders craft a targeted outreach strategy, increasing the efficiency and effectiveness of their fundraising efforts.

Partner & Customer Scouting for BD Teams

Business development and sales teams employ aVenture to scout for potential partners, customers, or acquisition targets. By tracking companies within specific verticals or those exhibiting growth signals like recent funding rounds or hiring surges, BD teams can build qualified prospect lists. The platform's insights into a company's business model and market help tailor partnership proposals and sales outreach for higher engagement rates.

Frequently Asked Questions

What is the source of aVenture's data?

aVenture aggregates data from a comprehensive network of over 1,200 primary and secondary sources. This includes regulatory filings, news publications, company websites, press releases, and direct contributions from venture capital firms. The platform's live metrics indicate continuous ingestion and validation, resulting in a database with over 12.8 million data points covering 109,000+ companies, 29,779 investors, and 211,035 key people to ensure institutional-grade reliability.

How does the AI analyst differ from standard news alerts?

The AI analyst goes beyond simple news aggregation by performing contextual analysis and synthesis. It reads full articles and reports to distinguish between routine updates and material events, summarizing key takeaways related to company traction, risks, and strategic shifts. This provides users with actionable intelligence rather than a raw feed, saving significant time on manual research and interpretation of market developments.

Can I track specific themes or sectors beyond individual companies?

Yes, aVenture allows users to follow not only specific companies and investors but also broader industry themes and sectors. Users can set up tracking for tags such as SaaS, Healthtech, Fintech, or Cleantech. The platform will then deliver consolidated updates and signal tracking relevant to that theme, surfacing new companies, funding rounds, and news trends that match the selected criteria for comprehensive thematic research.

Is the data exportable for use in other applications?

aVenture provides robust data export capabilities directly from its workspace tools. Users can export saved lists, company profiles, and filtered search results into standard formats compatible with spreadsheet applications and other business intelligence tools. This facilitates further quantitative analysis, the creation of custom reports, and the integration of aVenture's data into internal models and presentations.

You may also like:

finban

Plan your liquidity so you can make decisions with confidence: hiring, taxes, projects, investments. Get started quickly, without Excel chaos.

Zignt

Zignt simplifies contract management with secure templates, seamless sharing, and automated signing for faster workfl...

AILeadz

AILeadz automates lead generation by finding, verifying, and contacting prospects using AI and a database of 450M+ em...