PromptingPicks

PromptingPicks is an AI-powered search engine for discovering and tracking stock performance watchlists.

Visit

About PromptingPicks

PromptingPicks is a sophisticated, AI-enhanced financial analysis platform engineered for investors seeking a data-driven edge in the stock market. It functions as a comprehensive terminal that aggregates, analyzes, and presents critical financial data through an intuitive interface. The platform's core capability lies in its powerful search and screening engine, allowing users to effortlessly query stocks and access deep company information, from fundamental metrics and balance sheets to real-time price action. Users can organize their research by creating and managing multiple, fully customizable watchlists. A central feature is the virtual portfolio tracker, which enables the simulation and performance monitoring of investment strategies without capital risk, providing invaluable backtesting and learning opportunities. Integrated news feeds and analytical tools deliver contextual market intelligence directly alongside asset data. PromptingPicks is designed for retail investors, financial students, and aspiring analysts who require a professional-grade research toolkit to inform their decision-making process, consolidate their market watch, and develop disciplined investment methodologies.

Features of PromptingPicks

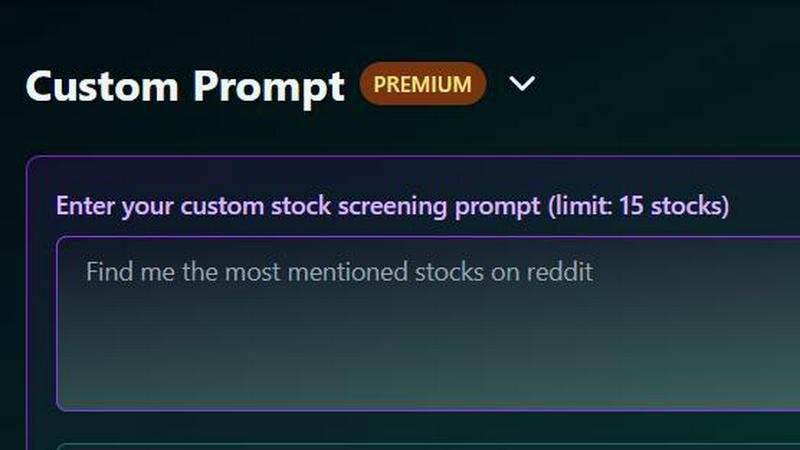

Advanced Stock Search & Screening

The platform offers a granular, multi-parameter search engine that allows users to filter the equity universe based on a comprehensive set of criteria. Users can screen by market capitalization, sector, P/E ratio, dividend yield, debt-to-equity, 52-week price performance, and a multitude of other fundamental and technical indicators. This enables the rapid identification of investment opportunities that match specific, user-defined strategic profiles, transforming raw market data into actionable shortlists.

Dynamic Virtual Portfolio Management

This feature provides a fully functional portfolio simulator where users can allocate virtual capital to build and manage model portfolios. It tracks key performance metrics such as total return, daily P&L, sector allocation, and individual position performance against relevant benchmarks. The system automatically updates holdings with real-time or delayed price data, allowing for realistic scenario analysis, strategy validation, and risk assessment without any financial exposure.

Consolidated Financial Data & News Integration

PromptingPicks aggregates and structures essential financial data for each tracked company, including income statements, balance sheets, cash flow statements, and key ratios. This information is seamlessly integrated with a curated feed of relevant financial news and press releases. The contextual presentation ensures that breaking news and market-moving events are immediately associated with the affected securities in a user's watchlists or portfolio, streamlining the research workflow.

Customizable Watchlists & Alerts

Users can create an unlimited number of watchlists to organize securities by theme, strategy, or interest level. Each watchlist supports custom column views to display the data points most relevant to the user's analysis. Furthermore, the platform supports configurable price and volume alerts. Users can set notifications for specific price thresholds, percentage gains/losses, or unusual trading volume activity, ensuring they never miss a critical market movement.

Use Cases of PromptingPicks

Investment Thesis Development and Backtesting

An investor can use the virtual portfolio to rigorously test a new investment strategy. For example, after using the screener to identify a list of high-dividend, low-debt companies, the user can allocate virtual funds to this basket within the platform. By tracking the performance of this model portfolio over weeks or months against an index like the S&P 500, the investor can gather empirical data on the strategy's risk and return profile before committing real capital.

Educational Tool for Finance Students

A student learning securities analysis can utilize PromptingPicks as a practical lab environment. They can research real companies, analyze their financial statements side-by-side, build watchlists for different industries, and construct virtual portfolios to understand correlation, diversification, and market dynamics. This hands-on application of theoretical concepts accelerates learning and builds market intuition in a risk-free setting.

Active Trader's Market Monitoring Dashboard

A day trader or swing trader can configure the platform as a central monitoring hub. They can maintain multiple watchlists for different market sectors or volatility tiers, with columns set to display pre-market gap, relative volume, and key technical levels. Integrated news alerts help them stay ahead of catalysts. The consolidated view eliminates the need to switch between multiple broker and news websites, increasing operational efficiency.

Long-Term Portfolio Review and Rebalancing

A buy-and-hold investor can use PromptingPicks to conduct periodic reviews of their actual investment holdings (manually entered as a virtual portfolio). The platform's analytics can highlight changes in sector concentration, track dividend income projections, and flag any holdings whose fundamental metrics have deteriorated based on updated financial data. This informs disciplined rebalancing decisions to maintain target asset allocations.

Frequently Asked Questions

What data sources does PromptingPicks use for its financial information?

PromptingPicks integrates with multiple premium financial data providers to ensure accuracy and comprehensiveness. This includes real-time and delayed price feeds from major exchanges, fundamental data from standardized corporate filings (10-K, 10-Q), and curated news feeds from reputable financial journalism and press wire services. The specific providers are selected for their reliability and low-latency data delivery.

Is the virtual portfolio feature connected to my real brokerage account?

No, the virtual portfolio is a completely separate simulation environment. It is not linked to any external brokerage or bank accounts. All trades and capital within the PromptingPicks virtual portfolio are simulated. This design ensures user security and provides a safe space for strategy testing and education without any risk to personal funds.

Can I export data or analysis from PromptingPicks for external reporting?

Yes, the platform includes functionality for data export. Users can typically export watchlists, portfolio holdings, and performance data into common formats such as CSV or Excel files. This allows for further analysis in spreadsheet software, integration into personal financial models, or inclusion in external reports and presentations.

How frequently is the news and financial data updated within the platform?

Financial data, including stock prices, is updated according to the chosen data plan, ranging from real-time streaming to 15-minute delayed quotes. Fundamental data (e.g., financial statements) is updated shortly after companies file official reports with regulatory bodies. News feeds are aggregated and pushed to the platform in near real-time, ensuring users receive timely market-moving information.

You may also like:

Session Stacker

Session Stacker helps side hustlers stay focused by setting their next task before closing their laptop. Pick up exactly where you left off.

Vibrantsnap

Record your screen, get a polished product demo. AI auto-edits, adds voiceover & captions in minutes. Free for Mac & Windows.

ConvertBankToExcel

AI-powered bank statement converter. PDF to Excel, CSV, QBO & OFX in 30 seconds. 99%+ accuracy for accountants & bookkeepers.