Portfolio Genius

Portfolio Genius is an AI-powered advisor that analyzes markets and executes trades automatically.

Visit

About Portfolio Genius

Portfolio Genius is a sophisticated, AI-powered portfolio management and analytics platform engineered to transform individual investment strategy through data-driven automation and intelligent insight generation. It functions as a comprehensive stock portfolio tracker augmented by advanced artificial intelligence that continuously analyzes global markets, real-time news sentiment, company fundamentals, and your specific holdings. The core value proposition lies in its ability to synthesize vast, disparate data streams into actionable trade suggestions with transparent reasoning, effectively serving as a 24/7 AI investment analyst. The platform is architected for a broad spectrum of users, from beginners seeking guided education to busy professionals requiring time-efficient portfolio oversight and experienced traders looking to augment their strategies with multi-model AI analysis. It supports manual trade execution based on AI recommendations or fully automated trading via brokerage integrations, all within a unified dashboard for monitoring multiple portfolios and performance metrics. By offering a choice of underlying AI models (GPT, Claude, Gemini), Portfolio Genius provides unprecedented flexibility, allowing users to align the analytical engine with their specific risk tolerance and investment philosophy.

Features of Portfolio Genius

Multi-Model AI Analysis Engine

Portfolio Genius integrates multiple state-of-the-art large language models (LLMs), including GPT, Claude, and Gemini, allowing users to select the AI that best aligns with their analytical preferences. Each model processes real-time pricing data, financial fundamentals, market news sentiment, and web-sourced research to generate tailored buy, sell, or hold recommendations. This multi-model architecture ensures diverse analytical perspectives and detailed, chain-of-thought reasoning for every suggestion, providing a depth of insight beyond simple signal generation.

Automated Trade Execution & Manual Oversight

The platform offers a dual-mode operation for trade management. Users can review AI-generated suggestions within the dashboard and execute trades manually through their connected brokerage. Alternatively, for hands-off management, the auto-trading feature can be enabled to execute trades autonomously based on predefined AI strategies and user risk parameters. This flexibility caters to both active traders who desire final approval and passive investors seeking full automation, with all activities logged for performance tracking and pattern analysis.

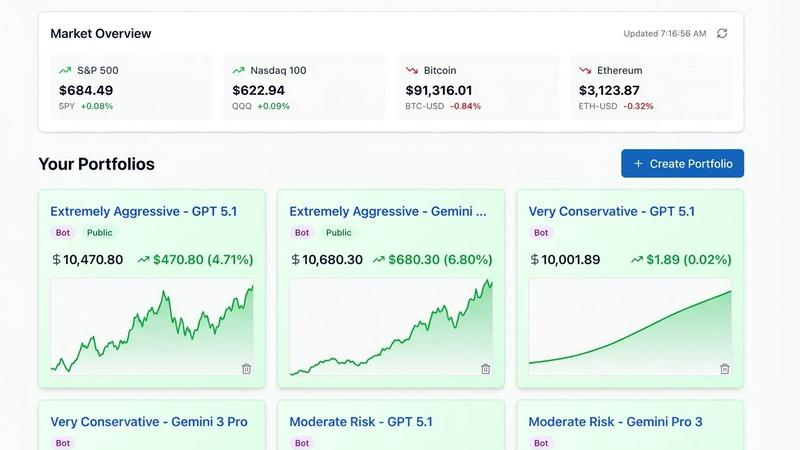

Real-Time Portfolio Analytics & Diversification Dashboard

This feature provides a bank-grade secure, unified interface for monitoring all investment holdings. It delivers real-time analytics on portfolio performance, asset allocation, and individual position health. A visual diversification breakdown offers an immediate snapshot of exposure across asset classes, sectors, and geographies, enabling data-driven rebalancing. The dashboard consolidates global market data for stocks, ETFs, and cryptocurrencies, presenting live metrics and comprehensive performance tracking across multiple, separately managed portfolios.

Conversational AI Interface & Portfolio Leaderboards

Users interact with the platform via a natural language chat interface, allowing them to query their AI advisor, request specific analyses, or discuss strategy in plain English. Complementing this is the public Portfolio Leaderboards feature, which displays the real-time performance of AI-managed portfolios categorized by strategy (Aggressive, Moderate, Conservative). This allows for comparative analysis of different AI approaches and provides educational insight into various risk-adjusted investment methodologies.

Use Cases of Portfolio Genius

Augmenting Decision-Making for Active Traders

Experienced traders utilize Portfolio Genius to process vast amounts of market data and news instantaneously, receiving AI-filtered trade ideas with detailed rationales. This augments their own research, helps identify overlooked opportunities or risks, and provides a second opinion grounded in quantitative and qualitative analysis, thereby enhancing the robustness of their trading decisions and potentially improving win rates through data-driven insights.

Passive Portfolio Management for Busy Professionals

Individuals with demanding careers who lack the time for daily market monitoring can leverage the platform's automated tracking and auto-trading capabilities. By setting a risk profile and investment goals, they can allow the AI to manage rebalancing and execute a strategic asset allocation plan autonomously. This ensures their portfolio remains actively managed and aligned with market conditions without requiring constant personal attention or manual intervention.

Educational Platform for Investment Beginners

New investors use Portfolio Genius as an interactive learning tool. The conversational interface allows them to ask questions about market concepts, while the transparent reasoning behind each AI recommendation provides insight into professional analysis frameworks. Observing different strategies on the public leaderboards and experimenting with portfolio construction in the demo mode offers practical, risk-free education in portfolio theory and market dynamics.

Strategy Benchmarking and Performance Analysis

Investors managing multiple portfolios or testing various strategies employ the platform's multi-portfolio dashboard to compare performance metrics side-by-side. They can assign different AI models or risk parameters to each portfolio and use the detailed analytics to benchmark which approach yields superior risk-adjusted returns over time, facilitating an empirical method for refining their overall investment methodology.

Frequently Asked Questions

Does Portfolio Genius provide registered investment advice?

No. Portfolio Genius is strictly a portfolio tracking, analytics, and educational information platform. The AI-generated analyses, suggestions, and insights are for informational and educational purposes only. The platform is not a registered investment advisor, broker-dealer, or fiduciary. All investment decisions and their consequences remain the sole responsibility of the user, who should consult with a qualified financial professional for personalized advice.

How does the AI generate its trade suggestions and analysis?

The AI system integrates and processes data from four primary sources in real-time: a pricing service for live market data, databases of company financial fundamentals and key metrics, AI-driven news aggregation with sentiment analysis, and authenticated web search for the latest research and analyst reports. The selected core AI model (GPT, Claude, or Gemini) synthesizes this data stream, applies financial analysis frameworks, and generates recommendations with explicit reasoning based on the user's portfolio composition and stated goals.

What is the function of the public Portfolio Leaderboards?

The Portfolio Leaderboards are an educational and comparative tool that displays the anonymized, real-time performance of various AI-managed portfolio strategies, categorized as Aggressive, Moderate, or Conservative. They allow users to observe how different AI-driven approaches (e.g., growth-focused vs. income-focused) perform under current market conditions. This transparency provides insight into strategy outcomes and helps users understand the potential risk-return profiles associated with different investment styles.

Is my financial data and portfolio information secure?

Yes. Portfolio Genius employs bank-grade, enterprise-level security standards. All user data, including portfolio holdings and brokerage connections (when used), is encrypted in transit and at rest. The platform uses secure, read-only API connections for brokerage integrations where applicable, following industry best practices to ensure sensitive financial information is protected against unauthorized access.

Pricing of Portfolio Genius

Portfolio Genius offers a simple, tiered pricing structure with a free entry plan and two premium subscription options, all featuring a 7-day money-back guarantee.

Free Plan ($0/month): Designed for basic use, this plan includes tracking for up to 3 portfolios, weekly AI portfolio reviews, basic AI recommendations, a limit of 10 trade suggestions per month, and access to community support channels.

Premium Plan ($20/month): This is the full-featured subscription for active management. It includes unlimited portfolios, daily AI portfolio reviews, access to all AI models (GPT, Claude, Gemini), unlimited trade suggestions, integration for automated trading with Alpaca brokerage, priority customer support, and early access to newly developed platform features.

Premium Annual Plan ($200/year): This plan offers the complete Premium feature set at a discounted annual rate, effectively providing two months of service free compared to the monthly subscription. It includes all Premium benefits plus priority email support and exclusive perks for annual members.

You may also like:

Beeslee AI Receptionist

Beeslee AI Receptionist answers calls 24/7, books appointments, and captures leads instantly to boost your business.

Golden Digital's Free D2C Marketing Tools

Free AI-powered Shopify audits and ROAS calculators for scaling D2C ecommerce brands.

Fere AI

Fere AI deploys autonomous multi-chain agents to research, analyze, and execute crypto trades 24/7.